1 min read

New York State May Require Wage Reporting to Match New York City

Alex Gonzalez

:

Jun 17, 2022 8:00:00 AM

Alex Gonzalez

:

Jun 17, 2022 8:00:00 AM

If passed, employers will be required to disclose a salary range in job postings to applicants and employees.

Employers with four or more employees may be required to include in job postings—externally for new hires and internally for promotion or transfer opportunities—the minimum and maximum salary for any position that is to be performed within the State of New York. Senate Bill S9427 was passed by the legislature and now goes before Governor Kathy Hochul for consideration. If enacted, the bill would take effect 170 days after it becomes law.

The New York law would require covered employers who post a new job opening, promotion, or transfer opportunity that can be or will be performed, in whole or in part, in the state of New York to (1) provide the compensation or range of compensation, and (2) provide a job description for the opportunity if such description exists. Employers would also be required to maintain records to support their compliance with these requirements.

The bill excludes temporary employment at a temporary staffing firm which is already required to provide wage range information to support the New York State Wage Theft Prevention Act.

OutSolve’s Take

Employers who have employees in New York City will have to implement these requirements by November 1, 2022. If signed by Governor Hochul, these requirements will broaden to all opportunities within the State of New York. Employers should note that similar requirements are being passed by states throughout the country and the spotlight on pay transparency is broadening. For these reasons, we continue to stress the importance of evaluating pay practices to prepare for scrutiny at the state and federal levels, both with the Equal Employment Opportunity Commission and the Office of Federal Contracts Compliance Programs.

Clients who are interested in taking preventive measures to evaluate their pay practices can reach out to their consultant or contact us at info@outsolve.com or by calling 888-414-2410. More information about our Pay Equity Analysis Services can be found on our website.

Alex Gonzalez recently joined OutSolve as VP of Product and Market Development. Alex will be working with the team to expand OutSolve’s offerings for clients and bring greater opportunities for growth and development to OutSolve. He has spent more than 30 years leading hundreds of clients in various industries in preparing affirmative action programs and diversity programs, implementing software solutions, and managing strategic product roadmaps.

Weekly OutLook

Featured Posts

5 Key Compliance Items HR Can’t Afford to Ignore

HR Compliance Checklist: What Every HR Pro Needs to Know

Related Posts

Legal Series: Top 4 Action Items for HR Regarding Pay Transparency

This article is part of an ongoing legal series designed to provide insight and practical guidance on current and emerging workplace compliance...

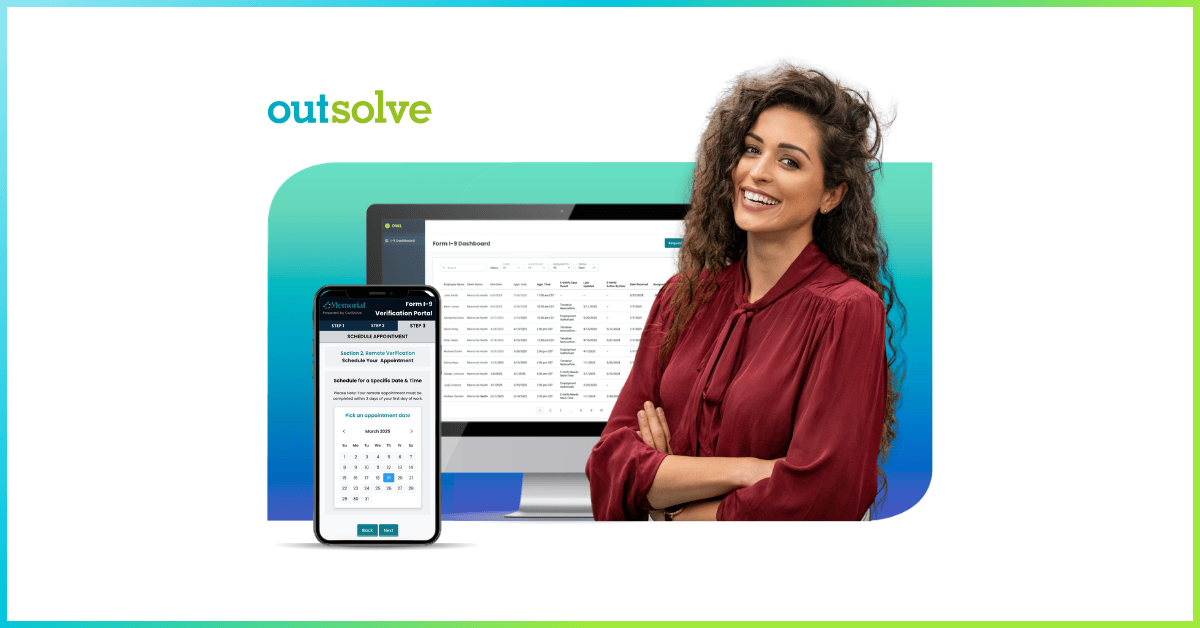

Should You Choose Software or a Service Solution for I-9 Management?

Most employers don’t realize how costly an I-9 mistake can be until it’s too late. A single missing signature or late verification can trigger fines...

DEI in 2026: What Employers Should Review, Keep, and Fix

The recent letter from the EEOC to Fortune 500 leadership signals a renewed focus on ensuring Diversity, Equity, and Inclusion (DEI) initiatives...